It's December again, and that means it's time to take another critical look at your health insurance. We can already hear you thinking, "Ugh, another to-do in this incredibly busy month," but it's important that your health insurance meets your specific needs . Women's health issues like incontinence, menstrual problems, and menopause can significantly impact daily life.

That's why it's important to know which health insurance policies offer you the best support. To what extent do health insurance policies in the Netherlands cover women-related conditions? Which insurers prioritize your health, and which don't? This blog post will tell you everything you need to know to make a well-informed choice.

Reimbursement for incontinence products: Are Moodies incontinence pants covered by my insurance?

Incontinence products are generally covered by basic health insurance, provided certain conditions are met. For example, the urine loss must last longer than two months or the fecal loss longer than two weeks, and the loss must seriously disrupt daily life.

However, not all types of incontinence materials are eligible for

Reimbursement. Washable incontinence products, such as Moodies Everyday incontinence briefs , are not always covered, even though they do absorb urine like other incontinence products. Furthermore, the incontinence briefs from Moodies' Everyday line are treated with an antibacterial wash to minimize odors. Therefore, check with your (future) insurer to see which incontinence products they do cover.

Does my insurance cover pelvic floor physiotherapy for incontinence?

Pelvic floor physiotherapy can be effective in treating incontinence. Pelvic floor physiotherapy focuses on training and improving the pelvic floor muscles, which are essential for maintaining  Supporting the bladder and controlling urinary incontinence. In addition, bladder training and advice on posture and movement can further reduce symptoms. For women experiencing incontinence, for example, after childbirth or during menopause, pelvic floor physiotherapy can be an effective way to regain control and confidence. Basic health insurance often covers up to the first nine pelvic floor physiotherapy sessions for urinary incontinence. It is important to note that in most cases, this reimbursement falls under the deductible.

Supporting the bladder and controlling urinary incontinence. In addition, bladder training and advice on posture and movement can further reduce symptoms. For women experiencing incontinence, for example, after childbirth or during menopause, pelvic floor physiotherapy can be an effective way to regain control and confidence. Basic health insurance often covers up to the first nine pelvic floor physiotherapy sessions for urinary incontinence. It is important to note that in most cases, this reimbursement falls under the deductible.

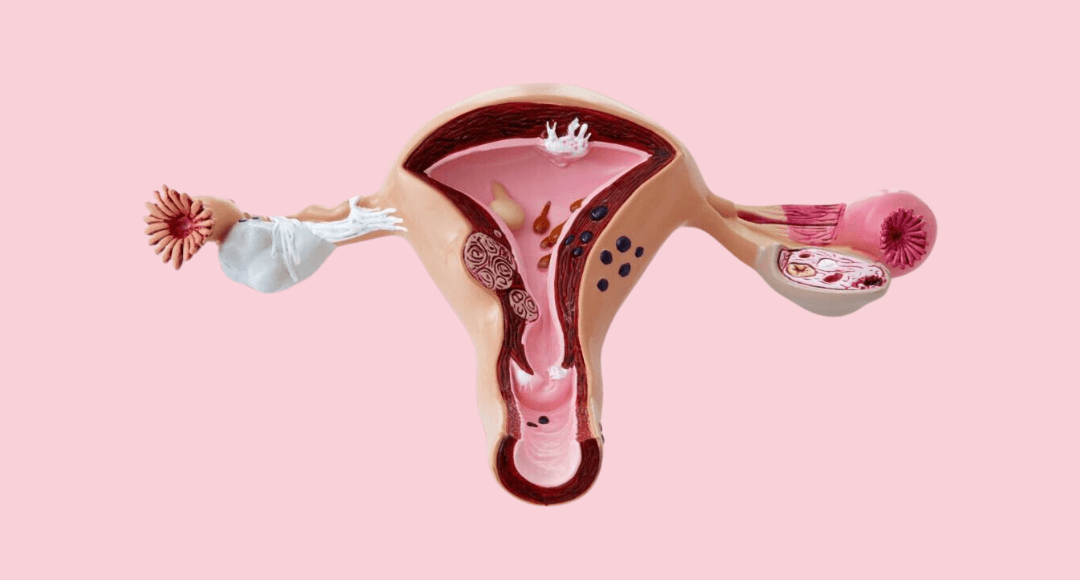

Referral to specialists for severe menstrual complaints

Women with severe menstrual symptoms, such as those caused by PCOS , endometriosis , or PMDD , are hopefully referred to the appropriate specialists. The general practitioner (GP) serves as the first point of contact and can refer patients to gynecologists or other relevant specialists for further diagnosis and treatment. Unfortunately, it still often happens that the symptoms of women experiencing severe menstrual symptoms are not properly assessed, resulting in them not being referred to the appropriate specialists.

For women experiencing heavy menstrual periods, they are usually referred to a gynecologist. This specialist can determine the cause of the symptoms and suggest appropriate treatments, such as medication, hormonal therapies, or surgical intervention if necessary.

Treatments and procedures prescribed by a gynecologist for severe menstrual pain are usually covered by basic health insurance, provided there is a medical indication. This includes diagnostic and surgical procedures and medications. All reimbursements are subject to your deductible. Always check the policy terms and conditions to avoid unexpected costs.

For women with PCOS (polycystic ovary syndrome), a dietitian can play a key role in improving symptoms through nutritional counseling, for example, focused on weight management or regulating blood sugar levels. Laser treatments are also sometimes used to reduce excessive hair growth (hirsutism), a common symptom of PCOS. These treatments are not covered by basic health insurance, but some insurers offer supplementary packages. Reimbursements may vary between insurers, for example, regarding the number of treatments or coverage for a dietitian. Therefore, it's important to carefully compare policy terms when choosing a health insurance plan.

For PMDD (Premenstrual Dysphoric Disorder), antidepressants can be prescribed to treat severe mood swings and depressive symptoms. This medication is usually covered by basic health insurance for medical reasons, but is subject to the deductible. For women with endometriosis, pain management, such as prescription painkillers or hormonal therapies, is also covered by basic insurance if prescribed by a specialist. Because both conditions significantly impact daily life, it is advisable to discuss treatment options and reimbursements with a general practitioner or specialist.

Health insurance policies that best support women during menopause, incontinence and menstrual complaints

Coverage for women's health issues varies by health insurer and policy. Some supplementary insurance policies offer reimbursement for menopause consultants or specialized care for hormonal changes. VGZ, for example, offers a budget for prevention that can be used for care related to hormonal changes, such as menopause or menstruation. Zilveren Kruis offers reimbursement, through its supplementary insurance, for consultations with healthcare providers affiliated with the Association of Nursing Menopause Consultants (VVOC). OHRA reimburses consultations and advice focused on menopause, premenstrual syndrome (PMS), and cancer prevention through its supplementary insurance, up to a maximum amount per year. Zorg en Zekerheid offers reimbursement, through some supplementary insurance policies, for menopause and PMS consultations with healthcare providers affiliated with the VVOC or Care for Women. ASR offers supplementary insurance policies with reimbursement for physiotherapy, alternative medicine, and preventive courses, which may be relevant for women's care. We therefore recommend that you carefully compare the policy conditions when choosing health insurance and pay attention to reimbursements for specific women-related care.

While coverage exists for various women's health conditions, there are still areas where coverage is limited. For example, alternative treatments for menstrual problems, such as acupuncture or naturopathy, are often not covered or only partially covered. It is therefore essential for women to thoroughly review the coverage their health insurance offers for women's health issues. By carefully reviewing the policy terms and possibly taking out additional insurance, you can ensure that the care you need is accessible and affordable.